Who does not dream of owning at least part of a city’s most valuable properties? And what about several prime locations? Unibail-Rodamco-Westfield is Europe’s biggest owner of mainly shopping malls, but also offices, in many metropolitan areas with high foot traffic. The stock is currently valued at a third of its “net reinstatement value”, i.e. its replacement or asset value as an investor would call it. 33% is less than Buffett’s famous “dollar for 50 cents” – is URW a buy?

Summary and key takeaways from today’s Weekly

– The decision to take on substantial debt to acquire Westfield in 2018 has in hindsight been very poor for equity holders as the stock fell by 75% – already including the after-2020 rebound.

– Management really messed up with trying to do an equity raise at the height of the 2020 panic.

– Since then, the turnaround is in play. Next year, the dividend will likely be reinstalled. However, all in all, this is a too risky adventure for me as I don’t like high debt loads, hence I am passing.

Unibail-Rodamco-Westfield (ISIN: FR0013326246, Ticker: URW) is not really known as a company, let alone a listed stock, despite being Europe’s biggest owner of prime-located shopping malls and some office and convention centers (the latter in France only) in core Europe, the UK and also in the USA.

The average person on the street likely won’t know who the owner of Westfield CentrO in Oberhausen (Germany), Gropius Passagen in Berlin, Westfield Mall of the Netherlands in The Hague (Netherlands), Westfield Shopping City Süd in Vienna, Westfield London, Westfield Mall of Scandinavia in Stockholm, Westfield Arkadia in Warsaw or Westfield Garden State Plaz in New York is.

Sure, there were lots of “Westfields”, but who knows who is behind Westfield?

The primarily French company should be a no-brainer investment with such a portfolio of assets, as city centers have always been experiencing high foot traffic and demand. Many companies should be happy to get some retail space to present their offerings in most of the time well attended passages – despite online shopping.

But how come that the publicly listed stock of such a company trades for only a third of its net asset value, instead of a premium of lets say 2x or even 3x?

The answer of course must be that there are certain issues.

These issues first and foremost spin around management errors in the past as well as a massively over-levered balance sheet. The enforced closures of 2020 and 2021 were not really helpful either, but the core problems already existed before.

One can argue that the higher the value of the assets held, the higher the leverage can be to sustain and later reduce the debt burden.

But, URW has huge debt problems. Also, URW does not pay a dividend.

It was suspended in 2020 for the following three years to preserve cash and shore up the balance sheet again. Now it’s the third year without payouts. However, the main thesis to buy shares of real estate companies are the usually high dividends. There’s a decent chance that it gets reinstated next year.

Although they present themselves as a turnaround in the making with ultra-low cost of debt, there are a few things one should know before investing in this stock – if at all.

A lucrative turnaround bet?

Today, we’re going to have a look at Europe’s shopping mall king.

Have you already signed up for my free weekly newsletter to receive alerts about articles like this? *

As a bonus for signing up, you receive a free research report from me!

* Visitors of my site with a mobile device will find the newsletter formular at the end of this article.

If you struggle to find high-quality investment ideas that are not already “priced for perfection”, consider becoming a Premium or Premium PLUS Member, where you will get exclusive research reports with my best stock ideas.

Unibail-Rodamco-Westfield at a glance

Unibail-Rodamco-Westfield is a French real estate company formed by the merger of first Unibail (France) with Rodamco Europe (Netherlands) in 2007 shortly before the Financial Crisis hit and later in 2018 through the acquisition of Westfield (Australia).

In late 2017, Unibail-Rodamco successfully bid for Westfield Corporation, which operated at that time 35 shopping centers in the US, the UK and Australia, for a reported price of 24.8 bn. USD. It should have been the big international expansion beyond mainland Europe’s borders for Unibail-Rodamco.

Just for comparison, today’s equity value of the whole entity is only 7 bn. EUR.

I think you see the leverage, but also the destructive nature of this megalomaniac deal, as the stock has lost close to 75% since the deal was closed.

–75% after the crash in 2020, already including the recovery.

The Australian malls branded as Westfield were not acquired back then.

The shopping centers already owned by Unibail-Rodamco before the merger had their names modified after the completion of this transaction to have the Westfield brand (as you have seen in the intro section).

As we will see later, this deal has been a rather big bite on which the company is still chewing.

Unibail-Rodamco-Westfield, or in short URW, owns many high-value commercial properties, particularly shopping malls, but also office space and event halls (or convention centers, in France) in many metropolitan areas and well-known big cities.

As URW writes itself, its prime-locations are offering a platform for retailers and brands “to connect with consumers”.

There’s nothing wrong with this concept or business model per se. Although mall traffic was declared dead in 2020 and 2021 at the latest, whenever I am in such a mall (maybe 1–2x a year), I see lots off traffic.

A dead business is something else.

Today, as of writing this Weekly, the Wall Street Journal reported (see here) that in the US regional mall traffic, i.e. outside of the prime locations, has been going down and that many department stores have had to close, negatively affecting the value of American shopping malls:

In 2019 or so I have been analyzing the biggest US mall owner of primarily the best and highest value locations, Simon Property Group (ISIN: US8288061091, Ticker: SPG).

The core issue was that in the US there were way too many malls and too much square meters or miles per capita compared to Europe. However, the prime destinations weren’t as affected as those regional ones mentioned by the WSJ.

Below, you can see the statistics from 2018, i.e. as of the time when URW bought Westfield and entered the US and UK markets.

You can already see above that the US was no only the market with the highest retail density, but also that this number was dramatically higher compared to mainland Europe. Luckily, one can say, that they did not also acquire Australia which was likewise densely retailed.

URW in its core is operating in a less dense “malled” environment – at least with its non-US malls which account for c. 80% of its exposure. URW’s properties are spread over 27 major cities in 12 countries on two continents.

Today, Unibail-Rodamco-Westfield operates 75 centers worldwide, after once having had more than 100 after the acquisition of Westfield.

Below, you can see the portfolio by segment and by region with France as the dominant location.

source: URW (see here)

Among the most successful are Westfield Stratford in London with an estimated 49 million visitors per year or Quatre Temps in Paris with c. 42 million visitors per year. In Germany, Centro Oberhausen attracts the most visitors per year with around 15 million (20 years ago or so I have been there once).

In total, 0.9 billion people are said to visit the group’s centers each year.

As you can see on the next screenshot, these numbers mentioned above at a time, namely as of the acquisition of Westfield, have been higher.

This is due to the issues URW has with its debt load, as it already sold several properties again to raise cash and lower debt.

The total value of the group’s existing portfolio currently is 51 bn. EUR or 150.7 EUR per share (as per its half-year results 2023; the screenshot above from their homepage is still showing the older and higher value).

However, this number in the past has even been higher – way higher.

URW’s equity value on the stock exchange is just 7 bn. EUR with this portfolio of high-value properties.

For the year 2014, i.e. four years before the destructive Westfield acquisition, Unibail-Rodamco was presenting a net asset value of where it is today – 151 EUR per share.

But then, it even climbed higher which was due to falling interest rates.

You won’t believe it, but the NAV increased further and peaked exactly with the acquisition of Westfield, reaching a high of 221.80 EUR per share.

That was up by a good 30% in just three years.

At that time, the stock also was somewhere around the 200 EUR area, at least being close to its proclaimed NAV. But it was not above it and certainly not significantly with a premium. I also don’t think that this will happen anytime soon.

A return to close to 1x would already be quite an achievement.

Now the stock changes hands for 50 EUR and a 0.3x valuation to its latest NAV.

This is insofar explainable, as in 2018 the US has been raising its interest rates from zero to 2.5%, while in Europe this was not the case. The higher interest rates lowered property values – those that URW just recently acquired.

That was the first crack from which it never recovered, despite zero interest rates again in 2020 and 2021, accompanied by other challenges.

All in all, net debt was 23 bn. EUR at the end of 2018 while its EBITDA was 2.1 bn. EUR in the same year. This was already a leverage ratio of c. 11x – a very high ratio and only possible due to these low interest rates back then.

But you see, everything had to go well and it was a very aggressive positioning.

Then came the 2020 and 2021 lock-downs. As a low on cash and “hand-to-mouth” business with tenants either going bankrupt or deferring rate payments, URW got knocked down. Despite its stock having recovered and doubled from the all-time lows, the situation today is still very fragile.

In the next section, we are going to have a look at what’s in store today.

The ugly truth – a way too levered balance sheet

Empire-building by executives, often without meaningful equity exposure themselves, is often a strong warning sign to be cautious.

When they use lots of debt, it becomes more severe.

More often than not, shareholder value gets destroyed this way.

The mess went so far as management is forced to sell expensively acquired property to raise cash again, lowering its rent income!

However, what really destroyed all the remaining, already fragile credibility was management’s attempt to raise a massive 3.5 bn. EUR at the height of the 2020 insecurity. At first, it seems logical to raise cash to strengthen the balance sheet.

But why didn’t they raise even 5 bn. EUR when the share price was 200 EUR in 2018?

The potential dilution would have been c. 20–25% (and less than 15% by raising 3.5 bn. EUR). Well, debt was too cheap and too tempting. Maybe otherwise the until then yearly raised dividend would have been needed to be cut – which happened in 2020 entirely, anyway.

The share price of URW was – of course – around its all-time lows when management tried to push through with its equity raise which would have diluted shareholders by some 80–90% or so (!).

Luckily – or not – this attempt failed.

The CEO was ousted and the equity raise was called off.

However, the weak balance sheet stayed which is still causing headaches for the new management. At the last capital markets day in 2022, management presented its new strategy for a comeback:

- sell its US properties that it acquired with Westfield in 2018

- also sell some non-core European assets, focus on quality

- use all the proceeds to repay debt and strengthen the balance sheet

For reference, LTV is the loan to value ratio which puts debt against assets. A few days ago, URW reported its H1 2023 results and net debt of c. 20 bn. EUR. Put against an asset value of 51 bn. EUR, the 40% target ratio is achieved.

But leverage is still too high!

And don’t forget that this time, compared to 2018, all relevant markets are raising interest rates! The US and the UK (which shall not be exited), have rates of more than 5% and the Euro-area of more than 4%. Don’t tell me that this won’t affect property values at all! This is why I think that the 51 bn. EUR figure could be in jeopardy over the next quarters, lifting again the LTV.

Management also showed a roadmap of what to expect should US properties be sold at losses to book values (in the bottom-right corner):

If URW manages to sell all its US assets for 100% book value (0% loss) which would be a positive surprise, then its LTV would drop below 30%. At –20% to book value which seems more realistic, the ratio would still fall below 35%.

In case the property values stay the same!

Some of the last transactions closed at losses of only between 10%–20% which can be seen rather as a positive (no irony), hence this seems realistic.

As to the dividend: A reinstatement for fiscal year 2023 is planned, meaning when management will be presenting this year’s earnings in 2024, likely it will also announce a dividend. To appease shareholders and maybe to bring in fresh interest for the beaten down stock (not without reason), the dividend is nearly a must.

But how high could the dividend be?

Assuming a share price of still 50 EUR and the guidance of 9.30–9.50 EUR in earnings per share (called “AREPS”; annual recurring EPS) and a payout ratio of 50% whereas prior the payout ratio was around 90%, this would result in a dividend of 4.65–4.75 EUR per share, or a dividend yield of more than 9.3%.

This sounds tempting.

However, I don’t feel comfortable with the debt, despite some early and light successes of lowering the burden. Below, you can see that the average cost of debt is still pretty low with less than 2% (red line).

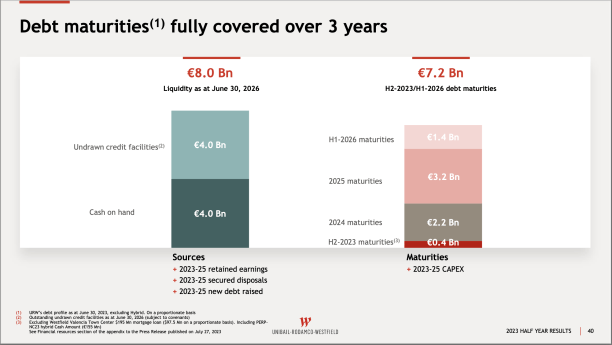

The good news is that all the debt either has fixed interest rates or is hedged via derivates, meaning regardless of what the central banks do, until the debt isn’t due, URW does not feel any pain.

But it is not realistic that all maturing principles will be paid back in the future, even more so when the dividend will be paid out.

At least, management showed that under normal circumstances they have access to enough liquidity to tackle all maturing debt over the next three years. A liquidity crunch should not happen again – hopefully.

However, half of the liquidity available is a credit facility, i.e. debt with a floating interest rate. Should URW pull it, then it will get expensive.

Likewise interesting is a recent closing of an outstanding hybrid bond, where URW offered the holders a prolonged debt-swap, i.e. more time for the management, in exchange for a higher interest rate.

Unfortunately, this interest rate is above 7%.

Though the whole construct will not kill URW, it is precursor of what to expect when URW will be in need of more refinancing.

Should interest rate stay high – and you should at least prepare for it to not be caught on the wrong foot – then the cost of debt will go up by a factor of 4x for URW.

Maybe even 5x, should the ECB go towards 5%? Who knows…

So even despite better results, higher rent income through inflation-adjustments and earnings, there’s a decent risk of way higher interest payments that together with the sold properties (lowering rent income) will sabotage earnings until debt gets repaid in a meaningful quantity.

This will likely also hold the share price back.

The bottom line, I am expecting the company to tread water. Hence, I’ll pass as there are way better opportunities out there to be explored.

Warren Buffett once said that “most turnarounds don’t turn”.

This is exactly the way I see it, too. That’s why I prefer to look for investments where the underlying business is experiencing tailwinds, not massive headwinds. Although the potential reward can be high and tempting, often such issues are too big and the investments too risky – at least for my taste.

That’s why I am presenting my members clear cases and ideas where challenges are at best minor and the road less rocky.

Below, you see the covers of the last two exclusive reports that my Premium PLUS Members received from me. The potential reward is (at least) as high as for URW, even higher, as URW is just a turnaround and not a growth story.

But the risks are smaller and the businesses are able to operate more freely, instead of shifting all financial means into debt repayments.

See also what some of my members are saying about my work:

Conclusion

The decision to take on substantial debt to acquire Westfield in 2018 has in hindsight been very poor for equity holders as the stock fell by 75% – already including the after-2020 rebound.

Management really messed up with trying to do an equity raise at the height of the 2020 panic.

Since then, the turnaround is in play. Next year, the dividend will likely be reinstalled. However, all in all, this is a too risky adventure for me as I don’t like high debt loads, hence I am passing.

By becoming a Premium or Premium PLUS Member, you get instant access to all my already published research reports as well as several updates.

Likewise, you qualify for eight, respectively three more exclusive reports with my best investment ideas plus updates on the featured businesses over the next twelve months.

Premium PLUS Members also get access to all Premium publications.