An important, but surprisingly little commented upon, news story prompted me to think about this very critical topic. Since most commonly known mining stocks often have no small exposure to emerging markets, I decided to dig a little deeper for my readers. I also take a look at some individual stocks and present two ideas with “pure-play Tier 1” exposure to gold and silver.

Summary and key takeaways from today’s Weekly

– Is there a wave of nationalizations of strategic resources on its way?

– What is already clear, is that a prudent investor shall apply a proper risk management approach.

– Most mining companies – the blue chips are not excluded – have significant exposure and dependencies on emerging, politically fragile markets. That’s why I am looking for companies that operate in safer jurisdictions.

I didn’t even actively think much about this topic before, but somehow I was already skeptical about too much exposure of mining companies to emerging markets.

To get straight to the point without too much of an introduction, this was the piece of news that put me on high alert about a topic that I was already subconsciously applying to my stock analysis of mining companies (and one of the reasons why I have such difficulties to find several proper mining stocks with good – not high – risk / reward ratios):

When I thought for a minute through what I have researched so far, I came to the conclusion that indeed most big mining companies often have significant exposure to Latin American and African, sometimes also Asian mining projects.

Although the news above aren’t about any specific company, this doesn’t rule out that one or another couldn’t be caught on the wrong foot.

As most of my readers will know, I like commodity companies at this stage. But what stands in front of everything else, is risk management. I don’t want to wake up and find out that a mining company I have presented to my readers and / or I am personally invested in, has been suddenly stripped off its assets.

The last Weekly for February 2023 covers first from a broader perspective the question of nationalizations of strategic resources. Then in the second part, I will show you one specific example from 2021 where a gold mine was quasi nationalized, though in a very exotic location. Also, I will have a look at where some well-known big mining companies have their operations.

The closing will be an overview of two “pure-play Tier 1” mining companies with exposure to gold and silver production only in non-exotic, less risky geographies.

With this, let’s start.

Have you already signed up for my free weekly newsletter to receive alerts about articles like this? If you are visiting my site from a mobile device, you will find the newsletter formular below, at the end of this article.

As a bonus for signing up, you receive a free research report from me!

Nationalization of strategic assets– an overview

For more information see here, here, here, here, here and here.

The nationalization of a strategic resource – or also company or even a whole industrial sector – means that ownership and control change hands from private shareholders to state-owned. Besides strategic interests, often social responsibility is a commonly used argument.

However, it is not just about becoming the largest shareholder and silently collecting dividends, but more about actively controlling and even interfering directly into the respective operations.

Ramón Eduardo Guacaneme, who is a professor at the Sergio Arboleda University in Bogotá, Colombia, explains the main motives behind nationalizations as follows:

“Nationalizations are the result of a political process. This means they are not merely economic phenomena but are ultimately the manifestation of the desire of a ruler who considers that this is the best way to achieve two kinds of key results: winning over public opinion, and achieving an economic impact. From this viewpoint, the nationalization process isn’t something that happens over night.”

Professor Ramón Eduardo Guacaneme, Sergio Arboleda University in Bogotá, Colombia

This means that often it is also a politically motivated demonstration of strength. It is then used to spread certain messages or to fish for votes. But the reason can also be a protectionist element like the practical prohibition of an acquisition by a foreign entity.

Often mentioned in the same breath, but with a completely different meaning, is the word “expropriation”.

The difference – in plain language – is that the former requires an adequate compensation, while the latter is more a form of theft. It is debatable what price is adequate or appropriate, but it is defined and mandated by the UN’s “Charter of Economic Rights and Duties of States” that a monetary form of a buyout has to take place.

Likely the most prominent example from 2022 is the recent “acquisition” of the remaining shares of Electricité de France (EdF) by the French government with a 10 billion EUR offer.

As I already wrote in my article “Zombie companies – The Walking Dead?” (see here), this takeover is not just to be seen from a pure investment perspective. The chronically cash burning and highly indebted company will be able to better hide their losses under the state’s umbrella.

As France already owned more than 80%, there was no imminent danger to national security. But now public interest in this business will diminish.

From a historical perspective, nationalizations as well as expropriations aligned more with marxist and / or socialist economic theories, rather than free-market approaches. Some of the most important grabs of control that occurred in the last century, were among others:

- the takeover of the Zarist Russian Empire by the Bolsheviks and thus closing private businesses entirely

- later spreading also to other Eastern-European countries

- the nationalization of the oil industry in Mexico in 1938 or in 1951 in Iran

- the takeover of the Suez Canal by Egypt in 1956 (that led to a military conflict / response)

- the nationalization of all foreign businesses by Cuba in 1960

- Venezuela, under Hugo Chavéz, expropriating several Western oil and banking companies in the 2000s

- the expropriation of oil company YPF by the Argentinian government in 2012

There will likely be more examples, but I think you see the point.

All the above seizures – whether adequately paid for or not (rather not) – have in common that they affected the important energy sectors and / or some form of critical infrastructure.

What you don’t see in this short list so far, are mining operations. But this might change, soon, as the news about lithium (which is a metal) in Mexico from the top of this article already suggest.

To be fair, it does not always have to come to such extreme measures. What can also be often observed are milder forms of controlling the resources of a country. Typical examples are mining royalties, adjusted tax rates, imposing additional punitive taxes or the implementation of production and export quotas.

And – what might surprise some – these phenomena aren’t solely found in emerging, third-world markets with dictatorial governments.

Just look at the majority state-owned, Norwegian energy super-major Equinor (ISIN: NO0010096985, Ticker: EQNR), formerly known as Statoil.

Did you know that EQNR in most years has a tax rate of 60% to 80%? It is not so obvious, because this company generates such high earnings and (nearly) no one dares to suspect Western countries.

But see for yourself.

EBT (not EBIT) on the chart below stands for “earnings before taxes”. You will notice that the majority of EBT is taxed into the coffers of the government:

But let’s come back to the point of potential nationalizations of resources.

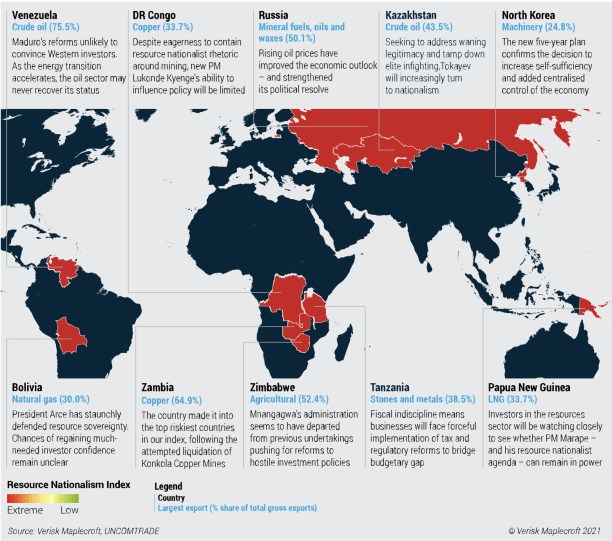

The researchers of Verisk Maplecroft regularly analyze the recent developments for 2021 (I couldn’t find a newer version) and evaluate the changing risks of potential nationalizations of resources as well as rising interference by the respective governments, giving them risk scores.

source: Verisk Maplecroft (see here)

In their 2021 outlook, the researchers write that 34 countries faced a higher, “significant” risk for state control of strategically important resources. The main reason is cited to be economical turmoil due to the challenging last three years (from today’s perspective) as well as higher necessities to plug fiscal deficits.

But it’s more than that.

Also environmental damages, resettlements of indigenous people (or other minorities) as well as questions of poverty, healthcare, clean drinking water, some exotic endangered species, etc. are on the table. I am not sure whether governments will be able to solve these issues, but they are all risks for the mining companies to consider from the perspective of an investor!

As many of these countries are highly dependent on exports of certain hydrocarbons as well as minerals, their governments obviously try to secure as high a stake as possible for themselves their people.

Especially the mining industry is mentioned as a more emerging sector in this regard.

It makes perfectly sense, as certain metals and minerals are in rising demand to fulfill many unrealistic ambitious energy and infrastructure projects.

To pour it together with some more recent developments:

The countries with increased risks are obviously emerging markets in Latin America as well as Africa. With the swings more to the left in countries like Chile, Peru, Brazil or even Colombia, nothing can be ruled out for sure. Africa has always been more opaque and difficult to assess.

But also resource-rich Asian countries like India and Indonesia have been making headlines about export controls of rice or palm oil (see my article about “Rising Food Protectionism” by clicking here).

There have also been ongoing discussions about even strikter measures (the article below is from 2019).

Indonesia’s economy has not only become about as big as Mexiko’s or Spain’s (see Statista’s overview here), but also one of the critical producers of certain resources like nickel, gold, copper and also coal or bauxite (needed for aluminum production):

The Grasberg mine mentioned in the article is one of the biggest gold and copper mines by output, hence no small fish! It should have been nationalized, but an agreement with a mining license into the 2040s was achieved (more on this later).

The metals and minerals that have gained in importance and which are said to face big supply deficits down the road are copper and lithium. But who says that silver won’t join this list, too, as it is needed for solar panels?

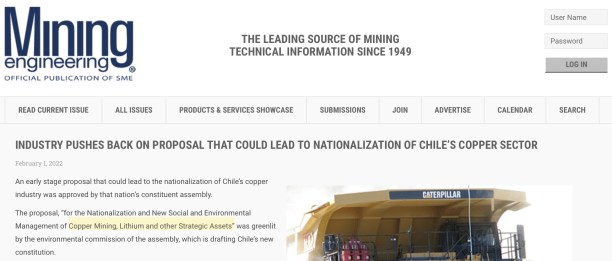

Certainly, you have heard of the turn to the left in Chile.

Why is Chile important? It is – by far – the biggest and thus most important copper producer worldwide with more than double the output than second ranked Peru which is also worrisome (see here)! These two together produce an astonishing 40% (!) of worldwide copper.

You see below – marked by me – that copper and lithium were mentioned as targets for a nationalization by Chile’s new government.

Agreements, licenses and contracts are one thing.

But when it’s about your own supply security and safety that is in question – or worse, if an aggressive ideology is pursued – I tend to guess that a new reality could set in. This would in the first place create a massive supply shock with the consequence of spiking prices.

Even more so if the commodity in question is of high importance.

But if you bet on the wrong horse and see the company you invested in being effectively expropriated, I don’t think you will benefit much from higher prices of resources.

With this, let’s look at a brutal governmental move in 2021 where a gold mine was nationalized and at the geographic exposure of some of the biggest mining companies.

A nationalized gold mine and high EM exposure

Have you heard of Centerra Gold (ISIN: CA1520061021, Ticker: CG)?

It is a Canadian gold and copper mining company that currently has its operations in North America and Türkiye. But before, its single biggest project, the Kumtor gold mine, was in Kyrgyzstan, a former Soviet republic in Central Asia, to the South of Kazakhstan and to the West of China.

Kyrgyzstan is a rocky country that officially has not much energy resources, unlike its neighbors like Kazakhstan. The gold mine Kumtor was seen as a good way to generate revenue for the government and to benefit from this precious source (see here).

Kumtor was seized by the Kyrgyz government under claims of environmental damage and Centerra had subsequently to write off a sum of 926 mn. USD. To put it into perspective, the whole company currently has a market cap of only 1.4 bn. USD. Legal steps have been taken which caused additional costs.

Here is a piece from Centerra’s 2021 annual report:

Of course such measures are not observed every day.

But nonetheless, if they happen, you surely don’t want to be sitting in this boat.

With this, let’s have a look at the operations of several big mining companies from a purely geographical standpoint.

Albemarle (ISIN: US0126531013, Ticker: ALB)

Albemarle is mainly known to be a lithium producer, but it has also other operations.

But let’s focus on lithium, its by far biggest resource and revenue generator with 68% in the last fiscal year. EBITDA contribution was even more than 90% as lithium prices have skyrocketed last year.

Albemarle has lithium operations in the USA, Australia and Chile:

In their risk section of the latest annual report 2022 (see here), they write on p. 10:

“foreign governments may nationalize or expropriate private enterprises”

How high could the damage of a potential Chilean nationalization be? Around 30% of the total amount of lithium mined by Albemarle comes from that region – though with a falling tendency:

This likely wouldn’t knock Albemarle completely off, but the damage in case of a loss of control would certainly be felt.

Now, let’s take a look at some companies with exposure to copper.

Southern Copper (ISIN: US84265V1052, Ticker: SCCO)

SCCO is a low-cost producer of copper, molybdenum, silver and zinc. It has the highest copper reserves of any listed company. Copper accounts for nearly 80% of total revenues.

It has active operations in Mexiko and Peru:

Roughly two thirds of operating income come from the Mexican operations and one third from the Peruvian.

As long as everything’s fine, the company has its advantages, like low costs. But you have to know that with this stock you have a pure play Latin American exposure.

Freeport McMoran (ISIN: US35671D8570, Ticker: FCX)

Likewise widely known is this producer of mainly copper and gold, but also molybdenum. FCX is active in North America, South America as well as Indonesia. Copper is the by far biggest source of income with 82% in the last fiscal year. Gold brought roughly 15%.

Do you remember the Grasberg copper and gold mine in Indonesia that was about to be nationalized in 2019?

Freeport McMoran is the company that received the license to operate there. And Grasberg is an important part of FCX’s portfolio.

Half of Freeport McMoran’s asset values is located in Indonesia which not only shows the heavy geographical dependency, but also the weight and concentration of the Grasberg mine alone, as the US operations with around 25% of asset value are spread over nine mines in total, with seven of them producing copper.

More than 50% of its copper reserves are located in Indonesia and South America:

For me, this is not a no-brainer if you’re looking for a primarily copper oriented business! If Indonesia shuts down, FCX will have BIG problems.

High risk and potentially high reward.

But I am looking for LOW risk.

Newmont (ISIN: US6516391066, Ticker: NEM)

Newmont is the biggest gold producer.

They claim that 90% of its gold comes from “Top-Tier” operations. For me, this would be mainly the USA, Canada and Australia (as there is no European exposure).

The 100 year old company also has some exposure to Africa and Latin America, not only with producing operations, but also through explorations.

When we look at the reserves by geography (the most recent is from 2021), we see that 45% of reserves are in South America and Africa combined, i.e. far away from the proclaimed 90%.

At least put against my understanding of what “Top-Tier” is.

source: Newmont 2021 Reserves and Resources (see here)

To put one additional nail in the coffin, in the North American segment, Mexico brings more than 50% of North American and 18% of total revenues with its Peñasquito mine.

So, no. I don’t feel 90% safe.

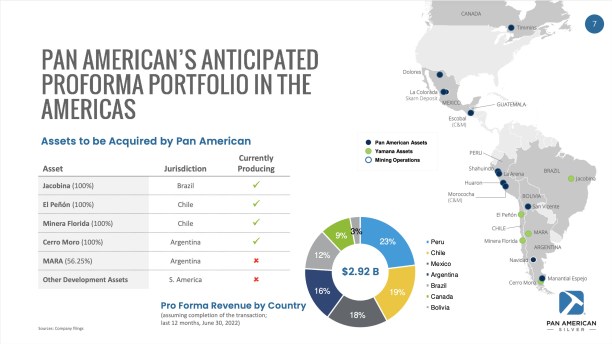

Pan American Silver (ISIN: CA6979001089, Ticker: PAAS)

This company should be renamed to either Pan American Mining or Pan American Gold, as it is not mainly a silver producer. With its most recent deal, gold will have an even higher relative share in its portfolio.

If you’re looking for a nearly pure play LatAm gold and silver miner, PAAS is a candidate:

And here are the nine month results by geography:

The single most important country so far has been Peru with a revenue share of close to 40%.

PAAS’s biggest silver reserves are in Guatemala. The mine has been on care and maintenance for about six years now, due to a governmental shutdown, triggered by a dispute with an indigenous minority.

All the above are well-known blue chip companies in their respective sectors.

However, for me, they are neither risk-free (as is none investment), nor even low-risk, as they all have material exposure to countries that are fragile for disruptions.

When you are already investing in a stock that is dependent on external factors the management cannot influence directly (price of a commodity, foreign politics, etc.), you should try to minimize those risk as much as possible, instead of blindly jumping into this pool of sharks.

In the final section for today’s Weekly, I’ll show you two companies that are solely operating in Tier 1 jurisdictions. However, they are not immediate investment candidates for me. I will explain why.

Two companies operating in Tier 1 jurisdictions

How do I define a Tier 1 jurisdiction?

For me, if a company has its operations in either Canada, USA, Australia or in Europe (for example Finland or Sweden), I feel much safer about the compliance with law and order than in Latin American, African or Asian countries.

Exceptions might apply, but this is my general view.

Maybe my view is ultra conservative and defensive, but I want to be better safe than sorry in this regard as potential disruptions are more or less already written on the wall.

I also thought prior that Mexico would be one of the safer locations in Latin America. Forget about that if you’re really risk-averse.

The first company is the biggest silver producer in the USA, Hecla Mining (ISIN: US4227041062, Ticker: HL). I already wrote about them briefly in my article about silver and some mining stocks:

“Is now the perfect time to buy silver again?” (see here).

Hecla has active mining operations only in the USA and Canada. They recently acquired a further Canadian soon-to-be operation with Keno Hill. Besides, they have exploration projects which – with just one exception (San Sebastián, Mexico) – are also located in the USA and Canada.

Hecla is presenting low production costs and has even a growth story to it.

But I have some problems with this case:

- too high debt for me

- sluggish financials, no constantly positive profit and cash flow

- shareholder dilution through rising share count

I am watching Hecla and maybe someday my assessment of it changes, but so far my gut feeling tells me to stay on the sidelines.

The second Tier 1 producer and the last company for today, is Agnico Eagle Mines (ISIN: CA0084741085, Ticker: AEM).

Agnico is not a 100% Tier 1 producer, but very close to it.

Together with Pan American Silver, Agnico is acquiring Yamana Gold (ISIN: CA98462Y1007, Ticker: AUY). PAAS takes the Latin American assets while Agnico buys the Canadian operations and increases its already significant Tier 1 exposure.

Besides Canada, Agnico has exposure to Australia (Fosterville) and even one mine in Finland (Kittila).

Its two Mexican mines, Pinos Altos and La India, together only account for less than 2% of Agnico’s total reserves. Revenues in 2022 were also below 2%.

Hence, we can call it a Tier 1 producer from a practical standpoint. Plus, it is a broadly diversified mining company with 20 mines or projects, if I counted correctly.

What I don’t like about Agnico is its price. The stock always has a high multiple attached to it. The current PE (which is not important for me) is currently 30x and the forward PE still more than 20x. Its EV / FCF multiple is also elevated with 40x.

The company is never cheap.

Also, management guided for further rising costs. It didn’t have the lowest costs in the first place and now margins will be further under pressure, if gold doesn’t move up.

On the other hand, it is a nice growth story, as it acquired a well-run low-cost competitor in Canada, last year. But you see, I have mixed feelings about this stock. However, I want to be fully convinced.

Personally, also I am not a fan of gold. I prefer silver where the supply and demand misbalance is obvious and where you have a real world use.

Conclusion

Is there a wave of nationalizations of strategic resources on its way? We’ll have to see.

But what is already clear, is that a prudent investor shall apply a proper risk management approach.

Most mining companies – the blue chips are not excluded – have significant exposure and dependencies on emerging, politically fragile markets. That’s why I am looking for companies that operate in safer jurisdictions.

By becoming a Premium Member, you get instant access to my already seven published research reports (one of them is free for newsletter subscribers) as well as seven updates.

Likewise, you qualify for eight more exclusive reports with my best investment ideas plus updates over the next twelve months.

You can preview my so far published exclusive reports by clicking here.

Get access to my Premium Member’s Area with a sign up by clicking here.