Who doesn’t like collecting dividends? Just receiving money on a regular basis for owning a few shares and waiting for payday. In fact, as I wrote last week, dividends have historically accounted for most of the total return on stock investments. But what if I told you that there are some companies that are in danger of cutting their distributions to shareholders?

Like I wrote last week (here), according to a very informative recent study form Hartford Funds called “The Power of Dividends” (here), dividends have historically been a rather underestimated factor. In case you haven’t already, do yourself a favor and look into this study. You will learn a lot!

Would you have known (in all honesty!) that the biggest part of overall stock performance comes from dividends, assuming they are reinvested? Unfortunately, because the underlying businesses often are more mature and less exciting, many investors find them boring.

This is short-sighted, however. You could also say, ignorant.

If you understand that dividend-paying companies are:

- far more reliable

- economically stable

- produce cash flow under all circumstances

- have even the best long-term performance

- and their stocks even fluctuate less

then there is no reason to avoid them. Quite the opposite, they should be the basis of every well thought-through long-term portfolio!

Whereas especially younger novice-investors tend to catch fancy tech stocks without proven business models in the hope of becoming a millionaire fast (and not even knowing what exactly they are buying), more experienced investors bank on dividend stocks for a good reason (or two).

There are many companies that pay out dividends regularly. A fraction has even a long history of consistent distributions. They do not cut their dividends, even during times of economical or political stress.

The cream at the top even raises its dividends every year!

As a rule of thumb you can say that the longer the history of uninterrupted payments, the more popular these stocks become because they have already proven themselves.

Unfortunately, I have to play the party-crasher again.

What has worked out fine in the past, does not necessarily have to in the present and in the future. There are many dividend darlings that are in danger of having to either cut or even suspend their dividends entirely. In most cases, stocks of such companies are thrown out of many portfolios and the prices drop like stones.

In today’s Weekly, we are going to look at ten such dividend darlings that could disappoint their shareholders, soon. Better be careful!

Dividend basics you need to know

In brief, a dividend is a payout of a company from its earnings (see here for more information). This means per definition that the company must have (or at least should have) had certain earnings to be able to distribute a part of it to it shareholders.

This is the rough theory.

But what you should know as a practically-oriented investor, is that dividends are not paid from earnings from the P&L (profit and loss statement), but from the cash position the company has on its balance sheet.

If you had an old car or some old gold coins that gained in price over time, this would be a profit on your personal balance sheet. However, you would not be able to buy directly anything from that gain (price difference). You would need to sell your stuff entirely first to receive cash that in turn could be used to pay for something or to share it with someone else.

This is the difference between earnings and cash flow. Don’t let fool yourself!

Dividends can be paid in two forms: As cash dividends or as stock dividends (see here). The former is what we are focussing on, because it is the most common type of a dividend distribution.

Cash rises with cash flowing into the company. When you have enough cash, you can pay cash dividends on a sustainable basis without bringing the company in danger.

This is the reason why you should better stop looking at the “earnings” of a company, but instead focus always on the cash position and the cash flow of the business.

To assess whether a dividend payout is sustainable and covered by enough means on the company’s balance sheet, you need to determine the “payout ratio”.

Usually, a company’s dividend is put in relation to the earnings. Let’s say, a company has earned 1 USD per share in its last fiscal year and it is going to distribute 0.50 USD to its shareholders, then we are talking about a payout ratio of 50%.

But as I said, factually you need to check the coverage with cash flow. With free cash flow, to be more precise. Free cash flow is what is generated by the underlying business from its operations minus investments back into operations (maintenance and growth, so called CAPEX or capital expenditures, see here).

Dividends can be declared together with an earnings announcement or on a random day just in between. There are three types of dates you must know in connection with dividends (see here for more information):

- ex-dividend date

- record date

- payment date (or sometimes payable date)

After a dividend gets formally declared by the management (and approved beforehand by the board), next comes the ex-dividend date. This is the day on which the amount that is being paid out as a dividend gets subtracted from the share price. Real cash will leave the company, hence it needs to be subtracted from the company’s substance. The higher the dividend per share, the higher the dip in the share price, usually.

Should a company pay a significant or a special one-time dividend, however, it is not uncommon that share prices have “mysterious” dips on the ex-dividend date (mysterious for those that do not know about the big payout).

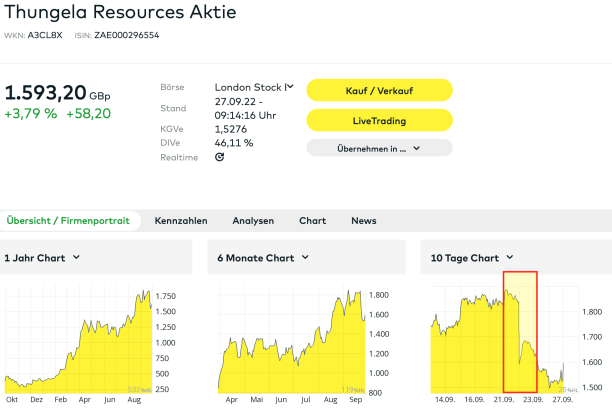

For example, last week the stock of South-African coal-mining company Thungela Resources (Ticker: TGA; ISIN: ZAE000296554) fell in London by around 15% on a day. Bad news? No, quite the opposite. A dividend of 300 GBp was subtracted from the share price. It was ex-dividend date.

However, most often you will not notice any meaningful price movement, when talking about the most reliable dividend payers with low dividend yields.

The second thing to know about the ex-dividend date, is that you must have bought the shares one day before the ex-dividend date at the latest.

If you buy the dip exactly on the ex-dividend date, you will not receive the dividend, because you were one day to late!

Technically, the reason lies in the so called “settlement” (see here for more information). It takes technically two days after you buy a stock before you are officially the registered holder. This “record date” in most cases comes exactly one day after the ex-dividend date. To be eligible for the dividend payment, you must be in the books at the end of the record date.

Hence, when you buy your shares one day before the ex-dividend date an hold it just overnight until the next trading session, you will be automatically qualified for the dividend payment. You could even sell your stock exactly on the ex-dividend date and receive the payout.

See this following table for a better understanding (all dates exemplary):

| declaration date | ex-dividend date | record date | payment date |

| 1 August | 13 August | 14 August | 30 August |

If you buy until 12 August and hold it this whole day, you will qualify automatically on 14 August (settlement of +2 days) for the payment on 30 August.

These are the very basics you need to know of the dividend-handcraft.

What more to know about dividends

1. Companies can pay dividends once a year (typically in Europe), bi-annually (typically in Great Britain), quarterly or monthly (typically in the USA and Canada).

Of course, there can be special dividends announced every time, for example like TotalEnergies (Ticker: TTE; ISIN: FR0000120271) did yesterday during its investor day (see here).

2. There are in general two types of dividend investing strategies:

- dividend growth investing

- dividend high-yield investing

Self-explanatory, the first group buys stocks that raise their dividends regularly. Over time, you will receive a growing income for your initial investment. Most often, however, the starting yield is low, because the underlying companies usually are growing businesses that reinvest significant parts of their cash flows back into operations for growth.

The second group seeks companies with higher initial payouts. Here, we often have more mature businesses that either only grow slowly or stopped growing entirely. Definitely, they don’t need most of the cash they generate. The higher leftover from operations can be paid out to shareholders.

3. There are many companies that are well-known for their dividends. The reliable passive income from their dividends most often is the main reason why they are held in many portfolios.

In fact, there are several companies that have paid dividends for more than 100 years, sometimes called “the century club” without interruption (see here). This doesn’t mean that they have raised their dividends every year, but for more than a hundred years a stockholder – assuming having lived that long – would have received at least one payment every year for more than a century.

Here is a selected overview of some companies from “the century club”, though not all:

| Company | Dividends paid since (years) |

| Exxon Mobil Ticker: XOM; ISIN: US30231G1022 | 1882 (140 years) |

| Eli Lilly Ticker: LLY; ISIN: US5324571083 | 1885 (137 years) |

| Stanley Black & Decker Ticker: SWK; ISIN: US8545021011 | 1887 (135 years) |

| Johnson Controls Ticker: JCI; ISIN: IE00BY7QL619 | 1887 (135 years) |

| Proctor & Gamble Ticker: PG; ISIN: US7427181091 | 1891 (131 years) |

| Coca-Cola Ticker: KO; ISIN: US1912161007 | 1893 (129 years) |

| Colgate-Palmolive Ticker: CL; ISIN: US1941621039 | 1895 (127 years) |

| General Mills Ticker: GIS; ISIN: US3703341046 | 1898 (124 years) |

| Church & Dwight Ticker: CHD; ISIN: US1713401024 | 1901 (121 years) |

| E I Du Pont De Nemours Ticker: DD; ISIN: US2635342080 | 1904 (118 years) |

The other two “clubs” of famous dividend payers are the so-called

- dividend aristocrats: raised their dividend every year for at least 25 years in a row

- dividend kings: raised their dividend every year for at least 50 years in a row

As of now, there are 65 dividend aristocrats (see here) and 45 dividend kings (see here). But we are not going to list them here, that is not our main topic.

After we had a longer introduction to dividends in general, we are looking next at my list of companies where I see higher risks of dividends at least being cut, maybe even suspended entirely.

My top ten companies facing dividend cuts

Dividend cuts can happen anytime. Even dividend aristocrats are not prone to cuts or even complete suspensions.

Take for example the two retailers, Ross Stores (Ticker: ROST; ISIN: US7782961038) or TJX Companies (Ticker: TJX; ISIN: US8725401090).

Both having been dividend aristocrats, they completely suspended their dividends during the height of the 2020 uncertainty for several consecutive quarters (from March 2020 until January 2021).

Currently, the dividends per share are even higher than before 2020 in both cases. To be fair, there was also no mismanagement, but an external factor.

I think you see the point, nonetheless. There is no guarantee for a payment.

In the graphic below, you see the quarterly dividend payments of three (former) dividend aristocrats over the last three years, including Coca-Cola (Ticker: KO below) which maintained its dividend:

Other companies, like Exxon Mobil, took on debt to continue their payouts during the most stressful times of 2020.

Not every case is the same, as you see.

However, I see many payouts being in danger at certain dividend darlings. Let’s have a look at them, one by one. I comment in every case why I think the dividends are not safe.

And be assured, their dividend yields are not only in many cases at very high levels, solely due to the overall market correction. It should be exactly the other way around.

As reliable dividend payers, their stocks should have fallen less, because garbage usually falls the most. In this regard, multi-year high or even all-time high dividend yields are more a sign of stress than a massive undervaluation no one is seeing. Don’t rush into them blindly!

Maybe it will help you not to be chopped like these bananas.

Dividends at risk of being cut or suspended

Altria (Ticker: MO; ISIN: US02209S1033) – current dividend yield: 9%

The company behind Philip Morris cigarettes (and other brands like L&M) in the USA was one of the most successful stock investments during the last century. This was mainly because of its consistent dividend payments. Mixed into that, you had a rather low valuation in this “sin stock”, due to its “dirty” perception.

But the winds have changed. Not only are there less and less smokers in the USA. You can only raise prices as long as you can. Demand being rather inelastic so far, will at some point in time drop. Or users will switch to cheaper non-premium brands.

The current administration is targeting a ban of high nicotine contents in cigarettes, too. Altria has nothing to offer in this regard as a substitute. In the recent past, Altria was losing even more volume (cigarettes sold in total) than their market.

Add to that the fact that Altria was not able to raise operating and free cash flows above their 2018 level (coincidently with their massive failures with the JUUL- and Cronos-investments). For more than half a century, Altria has been raising its dividend yearly. The current total payout stands at 6.5 billion USD per year. Free cash flow (8 billion USD) is covering this sum comfortably, as for now.

But Altria has 25 billion USD of net debt and only 1.5 billion USD left over after the dividend. The debt has a long maturity. But when you have pressure in your business, rising interest rates (need for refinancing at higher rates) and debt to be repaid, the time is ticking.

I expect very homeopathic increases until the dividend cannot be raised anymore as a base case. Should operating conditions worsen and the nicotine content be reduced by government, I’d expect a cut. Also keep an eye on the alternatives like nicotine pouches.

IBM (Ticker: IBM; ISIN: US4592001014) – current dividend yield: 5.4%

Our next stock is goo’old “big blue”, IBM. One of the most reliable dividend payers (and once the company with the highest market capitalization), its star has fallen down already a long time ago. IBM is not a trend-setting company anymore, but rather one that is trying to catch-up in the cloud-business.

I see rather dark clouds coming…

For at least a decade, if not even more, IBM is a major rebuilding site that tries to transform and reorganize itself. Revenue is not growing. The dividend was raised only by pennies recently, just symbolically.

IBM’s dividend costs it nearly 6 billion USD yearly at the current level. Being once securely covered, operating and free cash flow have fallen in the past massively. The last figures for the trailing twelve months stood at 9.8 billion USD operating cash flow and 8.2 billion USD free cash flow.

IBM has a similar debt problem like Altria. Net debt stands at 45 billion USD. I know, they have a financing business. But interest expenses make up 20% of operating income – and this in an until recently low-interest environment! Total interest payments are at a record-high 1.2 billion USD while the business is not growing. They will face refinancing at higher rates, too, just like Altria.

Intel (Ticker: INTC; ISIN: US4581401001) – current dividend yield: 5.4%

The story of Intel is different, because here debt is not the issue.

However, Intel is also a company that fell behind its industry’s trends. Being once the chip company, it first overslept the usage of chips in mobile devices like smartphones or tablets. Then it also lost market share to its way smaller main competitor AMD (Ticker: AMD; ISIN: US0079031078) as well as to companies like especially Apple (Ticker: AAPL; ISIN: US0378331005) that are designing their own chips, even in laptops and desktop computers. Apple quit Intel as their chip supplier two years ago.

After several CEO-changes, the current chief decided to transform Intel (hint: whenever you hear of a major transformation, you should be skeptical). Intel once designed, developed and produced its own chips only. The new plan sees Intel as being a producer for other companies, too – a so-called contract manufacturer.

The main, unofficial reason is, because they are behind the competition. But they are somewhat of strategic importance due to being a US company and having production facilities in the USA. Most chips worldwide are manufactured in Taiwan – a conflicted zone.

Intel’s dividend costs them yearly 5.8 billion USD. Free cash flow has been at least 10 billion USD over the last decade – except in the most recent past. To achieve its transformation, Intel committed to massive investments. They are building new factories for several billion USD.

Add to that, that Intel’s revenues are not growing and the entire industry is facing a harsh cyclical down-swing, currently. Intel and Nvidia (Ticker: NVDA; ISIN: US67066G1040) recently not only disappointed with their last results (way below expectations), but their guidances were underwhelming, too…

Over the last twelve months, free cash flow was even negative – before the dividend payment.

3M (Ticker: MMM; ISIN: US88579Y1010) – current dividend yield: 5.3%

3M is another well-known company. It is a kind of general store with products used in industry, at home or for medical purposes. The latter division will be separated in the future.

The company is also a somewhat cumbersome heavyweight. Its revenue has risen slightly over the last decade, but only thanks to some acquisitions. 3M paid around 10 billion USD in the last ten years for buying other companies. Even including divestures, the sum is more than a yearly operating cash flow. They were quite active, to say the least.

3M’s dividend costs them yearly 3.4 billion USD and is being raised yearly. In total, the dividend sum is twice as high as a decade ago. But on the financing side, the operating cash flow stands around the same level where it was ten years ago, at around 6 billion USD. That’s operating! Free cash flow sits at 4.3 billion USD – also no major improvement in comparison to ten years ago.

Like Altria and IBM, 3M, too, has a rather leveraged balance sheet. Net debt ist 14 billion USD, the leftover after the dividend payment just less than a billion USD. Here, debt is also structured over a longer timeframe. And you can expect a big chunk of it will be given to the to-be spun-out medical division with its more stable, less cyclical cash flows.

But interest expenses will rise, inevitably. And don’t forget that 3M is also a cyclical company – revenues, earnings and cash flows are under pressure in this current high-inflation environment.

AT&T (Ticker: T; ISIN: US00206R1023) – current dividend yield: 7.1%

AT&T is one of the most discussed companies and one where many inexperienced investors sink their money into. The stock has been no fun for most investors. It currently stands somewhere where it was 30 years ago. What kept many loyal and hopeful, was the consistent dividend.

Until it was cut, recently! This is also the only company we discuss today that has already cut its payout, recently.

But I think there is more to come. AT&T has a history of very bad capital management. Their most famous fail is the takeover of Time Warner that has been separated in the meantime, again. In this transaction, AT&T already cut its dividend without even announcing it this way. They just kept on going, as if nothing happened.

Still, AT&T is one of the most indebted and capital-intensive businesses, I know of. Telecommunication always needs investments to built out the newest infrastructure and to reach areas that still have no access to high speed internet or cellular reach.

We don’t have to comment on too long that AT&T is hardly growing. Interesting are the following numbers: Their net debt – even after the separation and dowry of several tens of billions of debt to Warner – is a sky-high 158 billion USD. It is more than AT&T’s current market cap.

Total costs for the (already cut) dividend rund at around 11.6 billion USD. Free cash flow was around 14 billion USD over the last twelve months. Hence, there is not much room to maneuver.

AT&T pays more than 6 billion USD yearly just for interest. Of course, AT&T will face refinancing in the future. Should their average interest just rise by 50% (assuming cash flows don’t fall), then the dividend will be hardly covered. When you observe, what is currently happening with interest rates, you will also see why a 50% increase is not far-fetched.

Newmont (Ticker: NEM; ISIN: US6516391066) – current dividend yield: 5.2%

Newmont is the first resource company on our list. It is the biggest gold producer and a big copper and silver producer. Surely, Newmont is the most cyclical of the pack so far, because their results are entirely dependent on the prices of gold, copper and silver. Thus, their results fluctuate the most.

This is obviously not their fault, but the environment they are operating in.

Net debt should not be a problem, as it stands at just 1.5 billion USD. With high metals prices, Newmont generated free cash flows in excess of 3 billion USD. The dividend costs them currently slightly more than 1.7 billion USD. But over the last twelve months free cash flow has come down to only 2.4 billion USD – thanks to declining metals prices. Since then, they have even fallen more during the current quarter.

I expect for one of the next two dividend announcements a cut in the payout, because cash flows will not cover it. Or, management decides to take on debt to finance the dividends. But this would but are reason on its own for me to stay away from this company.

Don’t fall for the high yield!

Digital Realty Trust (Ticker: DLR; ISIN: US2538681030) – current dividend yield: 4.9%

Digital Realty Trust is the second largest operator – after Equinix (Ticker: EQIX; ISIN: US29444U7000) – of data centers for enterprise customers like the Big Tech companies. Here again, we have a new type of business, as we are for the first time talking about a REIT (Real Estate Investment Trust).

These companies typically heavily rely on debt to finance their property transactions. Digital Realty is operating in a niche as data centers are not the common type of real estate. It is capital intensive to build and energy intensive to operate. Additionally, the customers are very strong ones, unlike usually the owner of the real estate is in the upper position for rent negotiations.

The amount of data is growing, hence data centers will be needed. What seems like a logical investment thesis and a forgone conclusion, will most certainly be a costly mistake for those that just buy on (wrong) perception without checking fundamentals.

Would you still be optimistic, if I told you, that occupancy at Digital Realty’s centers fell from more than 94% in 2015 into the low 80’s recently? Is this growing demand or good management?

Digital Realty Trust has net debt of more than 15 billion USD and pays yearly interest of nearly 300 million USD. They were lucky – like many in the industry – to having access to super low interest rates for debt to finance their growth. But higher refinancing will come. And maybe they overspent and overbuilt, just for the sake of growth?

The so far yearly raised dividend costs 1.4 billion USD in total. This is already most of operating cash flow. With rising interest rates and the need to refinance at higher costs, I see the dividend in danger here, too. Or management decides to swing from growth to just distributions. But this will stop dividend raises, anyway.

The other possibility is that Digital Realty will dilute shareholders with an equity raise at low prices to cover the debt payments whenever due.

No matter how you twist it, Digital Realty will be in a difficult position to keep up its streak of growth with cheap money and yearly raised dividends.

Iron Mountain (Ticker: IRM; ISIN: US46284V1017) – current dividend yield: 5.7%

Iron Mountain is again a REIT, but one with a very special business model. It operates buildings and underground storages for archiving physical copies of all sorts of documents like medical images, music discs or just tons of paper that needs space. Or in short, it is a “document storage and data management company”.

The problem here is of course that this is not a growing industry due to digitalization. Certain documents need to be stored physically on paper, but the trend goes down. Iron Mountain tried to diversify into the more promising digital storage and data centers. But like you have seen above at Digital Realty, this is not a no-brainer.

Iron Mountain too faces debt problems. They have 12.5 billion USD in net debt (around their market cap). Their average cost of debt is already rather high with 3.6% – we just came from a nearly zero interest environment. Already the whole operating cash flow is used just for the dividend payment. Every penny more in interest payments will only increase the pressure on the dividend.

The dividend per share has been raised just symbolically in 2020 for the last time. Since then, it is kept flat. The calm before the storm?

Omega Healthcare (Ticker: OHI; ISIN: US6819361006) – current dividend yield: 9.0%

This is the last REIT we are looking at today. Omega invests in buildings for assisted living facilities as well as nursing homes for elderly people. A promising business model with much expected tailwind at first glance, is very problematic, however.

Reimbursement rates are low (low affordability), nurses are in short supply and more and more people prefer to stay at home.

The financial health of Omega is another problem. Net debt is 5.1 billion USD, while operating cash flow (recently less than 700 million USD) is already consumed nearly entirely by the dividend. Like Iron Mountain, Omega Healthcare for the last time raised its dividend only symbolically two years ago. Since then, it has stayed flat.

Here we have again an already high payout that is facing a rising interest environment with the need to refinance a grand debt load.

Rio Tinto (Ticker: RIO; ISIN: GB0007188757) – current dividend yield: 10.2%

The last two years, especially 2021, have been very rewarding for investors of Rio Tinto (and many other resources companies), one of the biggest mining companies. Not only did it clean up its balance sheet (no debt anymore) right before the storm with record earnings, it also paid out huge dividends to its shareholders.

But the high payouts won’t last. To be fair, Rio Tinto cannot raise its dividend every year due to being a cyclical company. But when its earnings are high, of course, so are payouts, like in the recent past. Unfortunately, Rio Tinto is heavily dependent on iron ore prices.

This is not only the biggest contributor to revenues, but has also very high margins.

Prices for iron ore more than halved sind its high in early 2021. It doesn’t seem to get better, due to the worldwide economies still being in crisis mode.

Hence, you should expect results nowhere near the record numbers of 2021 for Rio and many other resources companies. The dividend could easily be halved.

Conclusion

All discussed companies have come down from their highs and most currently have very attractive dividend yields at first sight. But don’t get fooled just by high numbers! This could be a costly mistake.

You always have to look under the hood and understand what is happening under the surface. Are the companies earning enough to sustain their dividends? What about the debt situation or investment plans? Are the fundamentals sound?

In the end, a dividend is a voluntary service that should be paid only, if the economical situation of the business allows for it. Not every business above is in immediate danger of announcing a dividend cut or suspension. But some are, because rising interest rates will force them to refinance at higher costs, thus less cash flow will be left for shareholders.

I have good news in this regard:

In my first research report (exclusive for my Premium Members), I looked at an oil company that has not only a clean balance sheet, but is generating lots of cash from its favorably positioned business. The dividend ist adjusted every time after results are announced. The current base is already very attractive and securely financed from operations.

For just 99 EUR / year you get immediately full access to my research reports and future updates! Just click here.