Real estate investment trusts have been a favored asset class of many due to enabling property ownership without enslaving oneself with mountains of debt and without betting just on one horse. Other factors like liquidity, the ability to sale fractions of your ownership and often great shareholder returns have been other arguments. I was avoiding them on purpose – but there’s a sub-sector that could be interesting just right now.

Summary and key takeaways from today’s Weekly

– REITs are a very popular sector, mainly due to their dividends as well as in the past relatively low volatility.

– But higher interest rates are affecting them all. So, better pick wisely those who will struggle the least.

– An interesting development is occurring, presenting a great opportunity to take advantage of in the office sector – my Premium and Premium PLUS members are going to receive my latest stock idea.

Especially among cash flow focussed and less volatility-tolerant investors, REITs are often a central pillar of their diversified income portfolios. Over the last decades – with a pause during the Great Financial Crisis – most REITs have paid reliable dividends.

It was a virtuous cycle: buying shares of REITs, collecting dividends, reinvesting them, collecting more dividends, reinvesting them for even more future income and so on.

Producing a snowball that keeps on rolling.

But what has worked over the last 40 years as interest rates were falling until they didn’t, does not have to continue forever. Absurdly low interest rates were a strong tailwind and subvention for these companies as they could borrow way below historical norms. As such, it was an abnormal situation.

Self-explanatory, this led to exaggerations in stock prices and valuations.

Some REITs were even valued at such absurd levels, often having abnormally low dividend yields for this asset class, that I was wondering how one could invest as it barely could get any better.

When the risk-reward ratio is not favorable, i.e. not offering you limited downside and at least a decent upside, but instead limited upside with decent downside, then it is better to stay on the sidelines.

That is what I did.

We know what happened. Interest rates are way higher now and most REIT stocks are way lower, because there’s an inverse correlation. Higher cost of debt makes it more expensive for these companies to grow, as debt is an integral part of their financing. In fact, growth stops in most cases as profits are dramatically affected and balance sheets have to be strengthened.

This doesn’t mean that I view REITs in general as bad investments. But one has to look case by case and the more so if you want to beat the market.

While one could read in blogs, on twitter / X and watch in YouTube videos from novice investors recommending REITs as bulletproof investments, objectively, most of those ideas were simply not interesting for a serious, fundamentally oriented investor, but dangerous and ignorant for those blindly buying something they have heard of by accident.

What they mainly did, not having lived through economic cycles or spent time on historical developments, was using the recent past as the soil for their decisions, instead of asking questions like “what could go wrong?” or wondering about higher interest rates.

I’m sure today many of these pundits are sitting deep in the red with their purchases at the top, consoling themselves with their locked-in record-low dividend yields.

“Oh, it is just about the income. Stock prices don’t matter.” – Really?

If you’re down now by 20%, 30% or as much as 40% which is not uncommon even for sub-sector quality companies (!), then it takes you at least half a decade (pre-tax), just to be back to zero. Often even longer and all assuming that dividends won’t get cut.

My readers know that I have a different approach.

Not buying low-yielding investments that everyone else is chasing, but such that are out of favor, disliked, misunderstood, undervalued – or a mix of them all. As I still cannot warm up with most of the darlings from the REIT sector, I risked a look beyond the usual borders and found a hated sub-sector.

One REIT convinced me to write my next research report about it, exclusive for my Premium / Premium PLUS members (due next Saturday, 23 September 2023).

As a Premium Member, you are going to also have immediate access to 12 other reports as well as several updates.

Since I have started this blog and my memberships, the average total return of my closed ideas is +19.6%, comfortably beating the S&P500 and the iShares MSCI World ETF.

I am also ahead “live”, looking at all my active and closed ideas.

If you struggle to find high-quality investment ideas that are not already “priced for perfection”, consider becoming a Premium or Premium PLUS Member, to receive my exclusive research reports with my best and market-beating stock ideas.

Why I still don’t like most (darling) REITs

As I wrote in the intro section, there is a big correlation between interest rates and the stock prices of most REITs, as cost of debt is the central instrument for them. Markets are forward looking. At the moment, they are seeing and pricing in less growth (if at all) and worse earnings developments.

Less dynamic = lower valuation multiples. There’s no way to circumvent this.

Interest rates not only determine the cost of debt for these companies, i.e. their interest payments, which in return affect profits, but interest rates also influence property values – the main asset of these companies.

As these businesses are leveraged by nature, dramatically higher interest rates have a double-effect on them with the potential to smash them really hard. Many balance sheets and credit ratings use so called loan-to-value or loan to capital ratios where debt is put against the value of the assets held or against the market capitalization.

But as higher interest rates pressure property values (not all, but usually that’s the case, at the minimum slowing down transactions remarkably), priorly too optimistic companies can quickly start to feel the pain. Even if they repay some debt, the leverage ratio could still worsen, if property values have to be impaired.

As is known, asset values swing back and forth while debt stays.

That’s why, if you want to invest in REITs, one of the most important things to make sure (but not the only one!) is to pick companies with strong balance sheets. Another one is properties that likely won’t fall in value.

But it is not just looking at metrics like net debt to EBITDA.

You have to make sure that debt maturities are stretched way into the future and that no big walls are coming soon. The average cost of debt is also interesting, as seemingly low net debt to EBITDA ratios only tell half the truth, as ultra-low average cost of debt can multiply with refinancing, massively pressuring the ability to pay interest.

In other words, total debt can look better than it is due to too low cost of debt.

What I’d also like to see is some sort of a growth story or an uncorrelated setup, maybe a supply and demand imbalance that offers you a more favorable risk-reward constellation, instead of just hoping for the general consumer economy to do it.

In this environment, I also want to see an expected double-digit yield to have a decent margin of safety – not from the dividend, but earnings yield, i.e. the reciprocal of the commonly known price to earnings ratio, which is usually the FFO in this industry (funds from operations), as the PE is misleading.

Note: There’s a thing you should know about REITs and accounting:

The classical net income and EPS figures you’re familiar with include the depreciated assets. It is assumed that assets lose their value over time due to usage which in the case of machines, furniture or cars makes sense.

With properties which account for the majority of a REIT’s assets, it is in fact the other way around. With time, property values rise – or at least have risen. They are definitely not worth zero after their assumed lifespan (for accounting purposes). Are buildings older than 50 years automatically worthless? I don’t think so, especially not in prime locations or in the case of iconic buildings.

That’s why the industry has come up with their FFO figure which adds back the depreciated values, but also excludes one-time results from property transactions, offering a more balanced approach to its true cash earnings from operations (see here for more information).

What is also important is not to bet on lower interest rates to come to the rescue again.

What if they stay higher for longer, but debt has to be refinanced? Better be prepared! As many stocks which are seen as top-picks are down by 20% or even 40%, some sitting even at levels where they’ve already been one or two decades ago, you want to avoid picking those that will be forced to raise fresh equity at these levels.

This only shows the dramatic moves in this sector that has been rather quiet over the last decade, besides the 2020 interruption.

Before we come to my latest special situation idea, I first wanted to comment briefly on a few REIT darlings which were not attractive for me at low interest rates due to their high valuations as well as limited upside and still are not, despite having gone through painful corrections for those who bought them near the respective tops at ridiculous valuations and low dividend yields.

However, I am not doing full-scale analyses here, I only comment on what does not excite me from a big picture. It is just not worth it to chase what everyone else is.

While it is possible to achieve at these levels okay-ish returns, it is no recipe to beat the market, when you do what everybody else does. Unfortunately, you can find everywhere buy the dip recommendations and “the greatest buying opportunities”.

No, thank you.

There clearly hasn’t been any resignation and throwing in the towel, yet.

Such examples are the stocks of

- the uber-darling Realty Income (ISIN: US7561091049, Ticker: O)

- the dividend king Federal Realty (ISIN: US3137451015, Ticker: FRT)

- Public Storage (ISIN: US74460D1090, Ticker: PSA)

- American Tower (ISIN: US03027X1000, Ticker: AMT)

You will find more examples and certainly there could be an interesting smaller pick. I wanted to show you my perspective that is detrimentally opposing the broader view.

Let’s start with Realty Income or “the monthly dividend company” – which is how they promote themselves. This is a nearly holy company you are not allowed to say anything bad about. It is a so-called tripple-net REIT, meaning the tenants are responsible for all costs. Realty Income leases their properties to tenants from sectors like retail, health and fitness, convenience, dollar or drug stores and more.

More or less, the everyday locations one visits.

Its stock peaked exactly before the crash of 2020. Then it started a bounce back with the bottom of interest rates. You can also see that with the start of the hike cycle in 2022, Realty Income’s stock lost its recovering steam and fell back again.

Higher interest rates affect REITs – even the most loved ones.

Now, being where it was a decade ago and having a dividend yield of more than 5.5%, the question automatically arises whether this could be a good buy.

According to the dividend yield of the last ten years, this could be the case:

However, for me it is not convincing enough.

You also need to keep in mind that all the time in the above picture, there were low to zero interest rates present. Having short-term bonds at over 5%, there should be a premium or at least a growth story.

You should neither expect a meaningful price performance of the stock, nor dividend increases beyond symbolical moves as interest rates stay higher.

Despite its correction from 80 USD per share to now the low 50s, Realty Income still has a price to FFO of 13x, meaning the expected earnings yield is 7.7%. There is no trigger or catalyst in sight. Just business as usual. Also, the low share price is not favorable to raise equity. And higher interest rates that will come with refinancing, will pressure results.

Realty Income looks rather fairly valued, but not like a screaming buy. Maybe with an abnormal dividend yield of more than 7% and panic setting in among the dip-buyers?

Next up, Federal Realty, which is even more expensive with a P / FFO of close to 15x. It has increased its dividend for consecutive 56 years, hence it is a dividend king. Although since 2020 by just a penny each year only. FRT is also a retail-focussed REIT with similar tenants like Realty Income.

Higher cost of debt will make it hard for dividends to be raised at a faster pace.

Unfortunately, they are mostly operating in markets where my idea is staying away from for a good reason (I’ll come to that soon in the next section).

FRT’s stock is down around 30% from its high. The dividend yield is 4.5% and clearly too low to attract my interest, as it likely won’t be raised by much. Just symbolically. The expected earnings yield for this barely growing company is less than 7%.

Could be okay-ish, but no trigger, nothing special. Likewise the business as usual type.

Public Storage and American Tower are even more expensive and have even lower dividend and expected earnings yields. PSA has a P / FFO of 16x and AMT of even 18x, i.e. earnings yields of 6%, respectively a smidgen above 5%.

Both stocks came down by more than a third from their highs.

The dividend yields are 4.5% and 3.5%. Both are at best about to grow their earnings in the single-digits which is too low for such valuations. While PSA has low debt, AMT has a net debt to EBITDA ratio of around 7x.

With interest rates where they are, I would not expect anything signifiant here, either. There are also no special triggers on the horizon.

No screaming buys, nothing Mr. Market is giving you for free.

But how to check whether something is selling at a bargain?

Another method to value REITs, is to have a look at their net asset values and compare them to the equity market values, i.e. the stock prices (using the NAV per share which is especially interesting with companies that frequently dilute shareholders – it can and should be creating shareholder value, though).

As not every company publishes this figure and me wanting to show the big picture in this weekly, a first broad-brush approach is to look at the book value.

Here is a chart showing the price to book values of the four discussed companies:

While AMT seems absurdly expensive with 16x, also PSA’s 8x is rather lofty. FRT with 4.5x and O with even just 2.1x seem to be valued rather moderate, but for me all are carrying around premia to their net asset values.

I know this is not a perfect valuation method due to different ages and depreciated values of the assets, but with properties you can and should look at tangible values.

It is reasonable for a first big-thumbs impression.

Another is to compare the equity market cap to the estimated, self-calculated net asset values (here: net property values on the balance sheet minus net debt):

| REIT | equity market capitalization | est. net asset value (net property value – net debt) | est. Price to NAV |

| Realty Income | 38 bn. USD | 42 bn. USD – 19.9 bn. USD = 22 bn. USD | 1.7x |

| Federal Realty | 7.9 bn. USD | 7.7 bn. USD – 4.5 bn. USD = 3.2 bn. USD | 2.5x |

| Public Storage | 47.4 bn. USD | 16.2 bn. USD – 6.2 bn. USD = 10 bn. USD | 4.7x |

| American Tower | 83.7 bn. USD | 28.7 bn. USD – 45 bn. USD = –16.3 bn. USD | n.a. |

The table above, effectively confirms what the price to book comparison showed.

Nothing that immediately catches the eye.

If the underlying stories are rather uninspiring, meaning no special situation, no trigger, no event that could justify higher valuations, just business as usual – they all are passes for me.

Not so the story you are going to read about in the next section.

Office properties – absolutely hated

Who hasn’t heard of it and even experienced it themselves?

Working from home or remote has drastically altered the working environment. The biggest casualties were of course owners of office properties. Even after the turbulent years 2020–2022, the situation has not returned to where it was previously. It is unlikely to fully recover. More flexible approaches where one has to attend the office two or three times a week seem to have become the new norm.

More and more companies are ordering their staff back.

With not everyone being in the office at the same time anymore, though, in total less office space should be needed, right? Is it any wonder that this sub-sector should experience shrinking demand? At least for me, the tone in the news has been very negative, even seeing office REITs as doomed.

A foregone conclusion, as the respective stock prices seem to confirm this trend.

Or maybe not?

The final igniting spark that forced me to have a deeper look into this sector was the somewhat ironic announcement of Zoom Video Communications (ISIN: US98980L1017, Ticker: ZM) – THE poster child of remote working – that hybrid working will be the new norm, ordering its own staff back to the office.

It is a difficult situation.

On one hand, office space will be needed as companies are ordering their staff back. On the other hand, less office space will be needed.

As you can see from the table below, Office REITs are showing the highest number of individual companies with 20 publicly traded REITs (don’t forget that there are also private office property owners), i.e. there is very high competition in a likely shrinking sector.

When too many want to eat from the same cake, everyone will only get a few crumbs.

What this tells us until here is that there will have to be a big consolidation or at least several weak players leaving the field. But a complete obsolescence of office space and properties is highly unlikely, just using common sense.

Smart investors with a nose for opportunities know that herein lies the chance! Usually, troubled and doomed sectors are priced at a discount, aren’t they? From the second table, we can see that office REITs together with hotels and after malls have the lowest overall valuation, measured by price to FFO.

The sector average P / FFO for office REITs is just 8x at the time of the publication per end of August, meaning the expected earnings yield would be 12.5%.

But only in the case that earnings will at least be stable.

Keep in mind, that P / FFO does not look at debt – but debt is key here, as several competitors are going to have extreme difficulties.

Hence, the weak players likely still are not cheap, but even expensive and they should suffer more. As there are no sector-wide growth prospects, low multiples on average are likely justified. At least for as long as this sector is not en vogue again.

However, there will also be winners.

This is what I am looking for, as described above. A troubled sector with low valuations, but the potential to find a winner that surprises to the upside.

Just to have a quick look at a few examples, let’s pick the sector’s two biggest REITs by market cap, namely Boston Properties (ISIN: US1011211018, BXP) and Vornado Realty Trust (ISIN: US9290421091, Ticker: VNO).

The former has a market cap of 11.5 bn. USD, the latter 5.2 bn. USD. Below, you see the long-term charts that tell you something about the expectations about this sector.

While both don’t look exactly identical, especially when it comes to their respective all-time highs, both do show us that sentiment is really bad.

Both stocks are currently near their lows of the Great Financial Crisis.

What about their debt levels? BXP shows it in their investor presentation below. VNO strangely has not published an updated investor slideshow since 2019. But no, worries, I am going to uncover everything relevant.

BXP is talking about “conservative leverage” – a factor of more than 7x is not conservative for me. Maybe they are referring to VNO’s staggering and worrisome 20x (!), using the latest net debt and EBITDA numbers from TIKR?

Even looking back at what seem to be more normalized levels, VNO was always a bit ahead, in a negative way.

Without diving too deep into the debt topic and turning to my main point of this weekly, because it is way more important for the big picture before worrying about debt levels and maturities, let’s have a look at the regions where both are active.

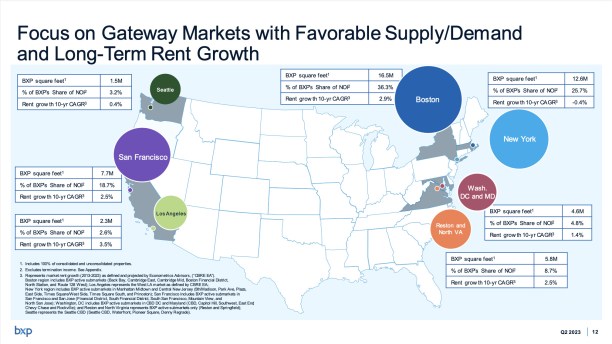

First, starting with Boston Properties which is not just limited to Boston.

Besides Boston, we see exposure to Washington (smallest), California, New York, the Maryland / Washington D.C. region and Virginia. Certainly some of the biggest cities and among the strongest economically.

VNO is heavily focussed on New York, with some Chicago and San Francisco exposure mixed into it.

Why is this important?

Not every state has the same characteristics and not the same economical strength, although at least Boston, New York, Seattle and California are certainly heavyweights.

Now, please look again at the chart from BXP’s investor presentation where they are writing in the headline:

“Focus on gateway markets with favorable supply / demand and long-term growth”

While true in the past, the reality seems to be a different one. I know that I am potentially touching here a hornet’s nest, but these are the facts. Being non-American, I am just presenting the facts-based results of my research.

All the states above are “blue states”, meaning democratically controlled.

Below, you can see from Wikipedia each state colored by the voting outcome of the last presidential elections since 2008 – deep blue having voted always blue and deep red always red. You can ignore the lighter shades.

Pinky Florida, however, will be important later.

And as we know further, the blue states are more tilted towards being less economically friendly. Plus, they had on average way stricter and longer enduring lockdowns and other measures. This has led to some interesting developments that are of utmost importance for the office sector.

First, let’s have a look at the economical development of a few states, starting with job growth:

The main message is:

With the exception of the state Washington, all the blue states where BXP is active have shown job growth that has not made into the top 10 list.

Leading states in this regard are Nevada (also blue, but not interesting here), then Florida and Texas and other red states like Tennessee, Utah, Alaska or North Carolina, where job growth rates have been between 3% and 5%.

While job growth could be a story for just a year and thus a one-time effect, let’s take a look at something that is rather more resilient and structural: population growth which includes organic growth and also net movements from other states.

I think this is speaking for itself, not showing a rosy picture for the above companies, but also not for office owners active in those states:

I think it is a bold, but clear statement. The second graphic even more confirms that:

- blue states are losing steam (New York even being the last with nearly a 1% population drop and California also in the negative top 10), all being lightly shaded (again with the exception of Washington state),

- while the important red states Texas, Florida, Georgia, the Carolina’s as well as Arizona are all showing strong population growth.

And this has first and foremost to do with the movement of companies and thus people. It is not something random.

Need evidence?

In the last linked article, besides Tesla (ISIN: US88160R1014, Ticker: TSLA) rather smaller companies are mentioned.

But it is no secret that other known names like

- McAfee

- Chevron (ISIN: US1667641005, Ticker CXV)

- Fair Isaac / FICO (ISIN: US3032501047, Ticker: FICO)

- Align Technologies (ISIN: US0162551016, Ticker: ALGN)

- Digital Realty (ISIN: US2538681030, Ticker: DLR)

- Charles Schwab (ISIN: US8085131055, Ticker: SCHW)

- Hewlett-Packard Enterprise (ISIN: US42824C1099, Ticker: HPE)

- Palantir (ISIN: US69608A1088, Ticker: PLTR)

have all left California. You can have a look here, if you’re interested in more details.

Random? Only a few outliers?

Most of the stuff above ist already two years old news!

Even Goldman Sachs moved a part of its business to Florida – a company that is not known to be die-hard red:

I hope the message is received and understood.

Maybe a few words on the bad debt situation regarding office properties: This should rather be a problem concerning highly-leveraged REITs or private property owners, especially in those states and locations with below average job and especially population growth.

These thoughts have led me to an office REIT that is likely going to take full advantage of the developments that by no means are one-time events. They are of structural nature and likely enduring. Companies don’t move their headquarters every one or two years because they don’t have anything else to do.

So, I searched for and found an office REIT that:

- is a pure-play on the states that are benefitting from the movements

- has its properties in class A locations – only the best

- is collecting higher leasing rates than pre-2020 and higher than the Class A average

- around half of its properties have been modernized since 2015

- has the best balance sheet in the whole sector (!) in total and also few debt maturities over the next years

- below sector average expiring near-term leases, long average lease durations

- is successfully implementing high premia for re-leases to new tenants

- on average, relatively young buildings

- a proven and calm management team, waiting for opportunities to strike

- an attractive dividend yield with a very low payout ratio

- a low valuation, below asset value

For me, this is the perfect way to play the developments described in this weekly.

As a Premium Member, you are going to also have immediate access to 12 other reports as well as several updates.

Conclusion

REITs are a very popular sector, mainly due to their dividends as well as in the past relatively low volatility.

But higher interest rates are affecting them all. So, better pick wisely those who will struggle the least.

An interesting development is occurring, presenting a great opportunity to take advantage of in the office sector – my Premium and Premium PLUS members are going to receive my latest stock idea.

By becoming a Premium or Premium PLUS Member, you get instant access to all my already published research reports as well as several updates.

Likewise, you qualify for eight, respectively three more exclusive reports with my best investment ideas plus updates on the featured businesses over the next twelve months.

Premium PLUS Members also get access to all Premium publications.