When talking about rare earths, most people likely think of China and its dominant position in this commodity sub-sector. Sometimes you will also hear about a “monopolistic position” of China. As we know, rare earths are critical for our modern lifestyles due to being key ingredients which are needed for high-tech electronics as well as for everything that is being moved physically with high efficiency by electricity. MP Materials is in the midsts of establishing a fully vertically integrated facility in the US. Is this the key to achieve independency from China?

Summary and key takeaways from today’s Weekly

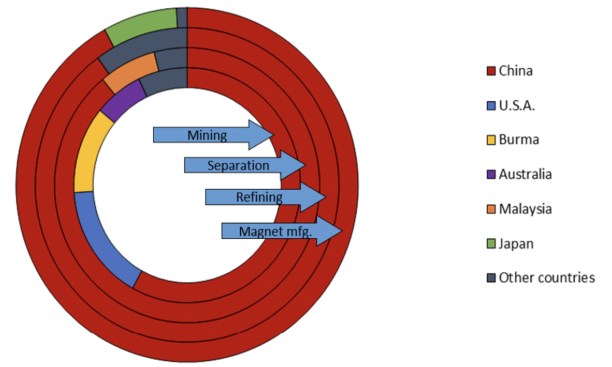

– China is by far the dominant player in the area of rare earth elements – the higher the value-add, the higher the dominance of China.

– But China is not the only country with big reserves.

– MP Materials intends to break this dominance by creating a fully vertically integrated rare earth production and processing facility in the US, even building critical permanent magnets. As an investment it does not attract me, however, due to different reasons.

Our modern lifestyles demand huge amounts of rare earths.

They are needed and used in many of our modern electronics end-products. Rare earths are also used in the processing of glass or metal alloys. According to current forecasts and plans, even larger amounts will potentially be required to achieve the energy transition goals of Western countries.

That’s the current status quo and likely not a big secret I am telling you.

However, there are several myths and facts about rare earths that are widespread, but often not properly understood. For example, it is not correct that only China possesses all the world’s rare earth’s reserves (also not 90% or so). Likewise, rare earths factually are not even rare – just to name two such myths.

I will put the facts on the table for you.

The other thing is, with the rise of consumer electronic end-products like smartphones, but also electric cars and wind turbines, rare earths have for at the minimum a decade been key strategic elements.

Needless to say that their importance has only grown over time.

As far as I can remember, there have been allegations from the West that China was using its dominant role (we’ll come to this later) to push prices down by oversupplying the market to not let come up any meaningful competition, artificially cementing their strong position and holding up the dependency of its trading partners.

There is an investable public company in the US, MP Materials (ISIN: US5533681012, Ticker: MP), that is working on bringing not only the upstream business (digging the minerals out of the ground) back on the soil of the US, but even more importantly to offer a fully integrated solution, including segregation and processing, even the production of needed magnets.

You don’t only need the rare elements, you need end products!

Already reading this, it should be clear that this company is increasingly becoming one of high strategical importance. Even more so if you know that these magnets are also components that are used for military appliances.

Together with the Western plans and the forecasted rising demand for rare earths in general and magnets in particular, this company should be a good pick – right? A clear bull market in sight, plus an emerging producer of much needed minerals and magnets – a lucrative long-term investment?

Today’s Weekly centers around these two topics – rare earths and the stock of MP Materials.

I am offering a reader-supported service. If you like my work and want to support me and my blog, please consider becoming a Premium or Premium PLUS Member, where you will get exclusive research reports with my best investment ideas.

Have you already signed up for my free weekly newsletter to receive alerts about articles like this? *

As a bonus for signing up, you receive a free research report from me!

* Visitors of my site with a mobile device will find the newsletter formular at the end of this article.

Rare Earths 101

“Rare earths” is an abbreviated term for “Rare Earth Elements” (in short: REE).

There are 17 different minerals – or elements – put into this whole group called REE. They are silvery-white metals, used as catalysts and magnets due to their conductive and magnetic properties. Common areas of application are consumer electronics, in engines / motors of electric vehicles and wind turbines, but also in the production of special metal alloys and glass. And don’t forget military equipment.

Of these 17 elements, you should keep in mind neodymium (Nd) and praseodymium (Pr).

Neodymium is used for strong magnets, often in connection with praseodymium.

Combining different such elements can be used to achieve certain desired physical capabilities. Hence, especially these two REEs are critical for the whole “green energy transition” thesis. They convert electrical energy into motion via rotation.

Factually and to clean up with a common misunderstanding, rare earths are not rare per se in the sense that there is not much of them. They are even abundant. The concentration of rare earths, however, is low or in other words: You need to move lots of rock to get your hands on these minerals in a substantial amount. Rare earths don’t come in a pure or highly concentrated form, but often together with other minerals.

And lots of waste material.

When you talk or read about rare earths, you will in most cases always be confronted with China’s dominant position. But it is also true that China is not the only country having reserves of rare earths. Far from it!

Here is a chart from Visual Capitalist that shows the world’s rare earths reserves as well as the production figures from 2020 by country:

By the way, the chart above was created using the USGS – The U.S. Geological Survey.

The key points to take home at this stage – regarding reserves – are:

- it is right that China has the highest reserves, but “only” around 38% – this is far away from the “gut feeling number” of 80–90%.

- there are also high reserves in countries like Vietnam and Brazil (both around 20% each), plus Russia and India.

- the US, Canada and Australia all have reserves in the top 10, either, but together not even 6% on a cumulative basis.

- some relatively large producing countries like Thailand or Madagascar have unknown reserves.

Reserves are one thing, the other is how much is dug from the ground. To answer this, the small graphic above in the bottom right corner gives us the answer.

China is also the largest producer, followed by – surprisingly – the US, Myanmar and Australia. Even more surprising is that Vietnam and Brazil, positioned second and third in terms of reserves, only made it to the ranks 9 and 10 – together producing even less than Madagascar or Myanmar.

And way less than the USA.

To put this more into perspective, China is responsible for around 58% of the world’s total rare earths production (per 2020), the US at least reaching 16%. I calculated these figures myself, using the data shown on the following table from the same source:

You can see from Statista how the market share of China developed since 2016 – it fell to 58%, until it rose again above 70%, recently (the last column being 2022)

As important as the location for the mining of these critical elements is, part of the truth is also that it does not stop with mining. You need to segregate all the different elements to get your hands on those you actually need and process them.

This is called separation and refining. And then you need end products – in the case of the “energy transition” it’s clearly magnets.

Although China’s share in the mining of REE’s has declined from 92% in 2010 to 58% in 2020 (to rise again into 2022, however, being lower than the former high), it still holds a critical 85% of the world’s refined amount (also per 2020) via its state-owned enterprises.

Here is a different source showing China’s shares of each steps, including also magnet production:

And here is the important observation: The higher value-add, meaning the closer to the end product (in this case magnets), the higher the share of China.

The only other meaningful magnet producer as of this graphic is Japan.

To break the Chinese dominance, this circumstance obviously has led many contries to take their destiny into their own hands by searching for own supplies, but even more importantly to get a handle on the following value-add processes.

And this is where MP Materials comes into play.

If you want to dive deeper into China’s position and also the recent consolidation of several of its state-owned enterprises, you can read on by clicking here.

Is MP Materials a no-brainer investment?

In response to the described Chinese dominance of the whole value-chain from rare earths production over sorting and processing to producing magnets as end-products, some Western countries over the years started to build up their own operations.

The motive is clearly not just to compete for profits, but even more so to decrease the dependence on supply of this strategically critical elements and products.

The US has been among the most active – maybe not so surprisingly.

In 2018, a long closed, but in the past already producing facility in California, the Mountain Pass Rare Earth Mine, was reopened by a company called MP Materials that purchased it a year earlier. Two years later, on 18 November 2020, MP went public via a SPAC deal (acquired by Fortress Value Acquisition Corp, a subsidiary of Softbank (ISIN: JP3436100006, Ticker: 9984) ).

After a euphoric surge due to this “bullish story”, but also significantly higher neodymium prices that nearly went up 4x due to the “renewables” and BEV boom, led by Tesla (ISIN: US88160R1014, Ticker: TSLA), the stock of MP Materials is now trading at the lowest level since the end of 2020.

Back to start, one could say. Or maybe we’ll see a new all-time low, soon, as profits are going to be pretty likely depressed at least in the near-term as commodity prices are down by two-thirds from their highs?

Who knows, but that’s not what I want to answer today.

On the following two charts, you can see first the evolution of the price of neodymium and then of the stock of MP which has nearly the same pattern (the stretch of the curve due to the different time lines is the only major difference).

Don’t get confused by the total return number of the stock of MP Materials. This number includes the SPAC’s price of 10 USD until the takeover and IPO. MP had a “true” first price of somewhere around 15 USD. But this shows you that the current stock price is not far away anymore from where it started.

In 2020, MP Materials said that it had already produced ca. 15% of the world’s rare earth content, making it the largest producer in the Western hemisphere. Quite an achievement! This is said to have been possible especially due to low production costs, accommodated by a comparatively high concentration in the rocks.

By the way, this is a common correlation in mining companies. When you have a higher portion of your valuable mineral in the rocks, you obviously don’t have to move and crush as much which is favorable for costs.

But the story doesn’t end here.

MP is working on and investing heavily in the creation of a fully vertically integrated rare earth and magnetics supply chain. They are making steady progress on their three-stage plan:

- Stage I is the already running upstream or production of rare earths from the ground.

- Stage II, also called “midstream”, is the segregation process needed to remove unwanted impurities and by-products. Here, MP is already on a good path as first operations started at the end of 2022.

- Stage III (downstream) will be the highest value-add step, finally enabling the production of magnets.

As MP writes in their latest annual report, after completion of Stage II, the company will be able to produce and sell separated rare earth products, focussing on neodymium-praseodymium oxide which is most often used for permanent magnets.

Then, after completion of Stage III, MP anticipates to be producing these permanent magnets, itself. As currently designed, the facility should be able to produce enough magnets for 500,000 BEVs.

The following slide from a recent presentation highlights the current developments:

This approach of a fully integrated value and supply chain makes MP Materials clearly a company of strategic importance for the US. Not only can it differentiate itself from mining-only operations. When realized, it will become a key-supplier for the military, but also the automobile as well as wind energy sectors.

There will be more use cases like in robotics, but these mentioned above should be the most important ones, especially as MP itself is preferably discussing them.

MP already secured and received government support from the Department of Defense (DoD, see here), but also in 2021 announced a long-term deal with General Motors (ISIN: US37045V1008, Ticker: GM) whom it will supply with critical magnets for its electric vehicles (see here and here).

In 2022, the construction of the rare earth magnetics facility (in Texas) commenced.

The current status quo, however, still shows the unwanted dependency on Chinese partners.

After having dug the key minerals out of the ground, MP still has to sell the vast majority of its rare earth concentrates to a Chinese company, called Shenghe which sells the purchased minerals to Chinese refiners for further processing. Those again sell them to their customers, until at some stage of the chain the magnets are produced.

US customers like automakers of BEV, robotics companies or wind energy producers then have to buy in many or even most cases those magnets back from China.

The goal to is cut out all those middleman to become a key supplier. Plus, the trend of the “green energy transition” should bring years or even a decade of strong growth. It seems rather safe to assume that MP will receive government support where needed.

Another interesting point is that MP could be in a strong bargaining position against its future customers (likely domestic businesses) as companies like automakers will be forced to secure their own supply. When supply becomes more important than the price, it looks favorable on this front for MP.

I would also guess that MP becomes more valuable in times of geopolitical tensions between the US and China, the more the vertical integration is completed.

Nothing is certain, but these arguments look valid to me.

I will now tell you why MP is NOT interesting for me.

It already starts with the high military involvement. I dislike this sector and principally do not invest in it, when there is such a massive connection. But there are more reasons, besides this one.

MP was profitable until recently. At the peak of the neodymium price, margins were even brutally high. However, this was a peak, not a permanent situation to plan with. The balance sheet has a small, but decent net cash position as of March 2023.

But there are some uncertainties.

As the underlying commodity prices cratered (neodymium), it is for me not so sure that MP will be able to still post positive results. Even if so, it is another question whether it will be able to generate enough cash flow for its investing needs. You definitely should not expect positive free cash flows in the short- to medium-term.

In Q1 2023, it was already negative. Is there more pressure to come? Will maybe also operating cash flows drop into the negative zone? Should this be the case, an unfortunate dilution of shareholders is likely, due to a then needed capital raise. Not good at low prices…

Last year, production costs have risen, as inflation is everywhere. On the following screenshot from their latest quarterly report, you can see that despite practically unchanged production volume (first line), production costs have gone up by a massive 24% (last line)!

Realized prices on the other hand were already 32% lower.

And third, there is one more big block of uncertainty for me where I do not feel comfortable enough.

As technology and science progress, there are also possible risks from these areas. Who says that the current NrPd oxide used for permanent magnets will not be replaced by a completely other mix of materials or minerals?

What may sound theoretical, indeed may not even be that far in the future.

Just look at some screenshots from different news sources:

All three articles above have in common that they write about critical supply coming mostly from China and that it is not always safe to secure supply to begin with. Hence, the works on and search for alternatives – and even the possible elimination of rare earth elements in certain products.

In the case of Tesla for example, they already used so-called induction motors that didn’t need rare earth magnets. On their last investor day a few months ago, Tesla announced the next motor generation to be without rare earths, again. However, the exact material composition was not revealed.

To conclude, it is not even safe that this seemingly “bullish environment” will even be that bullish, if critical materials can be substituted successfully. This is even a pretty big risk to the whole investment thesis that does not rely on management’s capabilities.

Conclusion

China is by far the dominant player in the area of rare earth elements – the higher the value-add, the higher the dominance of China.

But China is not the only country with big reserves.

MP Materials intends to break this dominance by creating a fully vertically integrated rare earth production and processing facility in the US, even building critical permanent magnets. As an investment it does not attract me, however, due to different reasons.

By becoming a Premium or Premium PLUS Member, you get instant access to all my already published research reports as well as several updates.

Likewise, you qualify for eight, respectively three more exclusive reports with my best investment ideas plus updates on the featured businesses over the next twelve months.

Premium PLUS Members also get access to all Premium publications.